- How much homeowners insurance do I need?

- Do I need separate coverage for jewelry?

- I’m installing a pool—what kind of insurance do I need?

- Where can I buy insurance?

- How do I pick an insurance company?

- How much will it cost?

- How can I save money?

- What does my credit rating have to do with purchasing insurance?

- What information do I need to provide to my agent?

- What if I can't get coverage?

- How often should I review my policy?

- Should I purchase an umbrella liability policy?

Wednesday, October 31, 2007

BUYING AND SAVING MONEY

Tuesday, October 30, 2007

What's the difference between cancellation and nonrenewal?

There is a big difference between an insurance company canceling a policy and choosing not to renew it. Insurance companies cannot cancel a policy that has been in force for more than 60 days except when:

- You fail to pay the premium

- You have committed fraud or made serious misrepresentations on your application.

Nonrenewal is a different matter. Either you or your insurance company can decide not to renew the policy when it expires. Depending on the state you live in, your insurance company must give you a certain number of days' notice and explain the reason for not renewing before it drops your policy. If you think the reason is unfair or want a further explanation, call the insurance company's consumer affairs division. If you don't get a satisfactory explanation, call your state insurance department.

The company may have decided to drop that particular line of insurance or to write fewer policies where you live, so the nonrenewal decision may not be because of something you did. On the other hand, if you did do something that raised the insurance company's risk considerably, like committing fraud, the premium may rise or you may not have your policy renewed.

If your insurance company did not renew your policy, you will not necessarily be charged a higher premium at another insurance company.

Monday, October 29, 2007

How do I take a home inventory and why?

Would you be able to remember all the possessions you’ve accumulated over the years if they were destroyed by a fire? Having an up-to-date home inventory will help you get your insurance claim settled faster, verify losses for your income tax return and help you purchase the correct amount of insurance.

Start by making a list of your possessions, describing each item and noting where you bought it and its make and model. Clip to your list any sales receipts, purchase contracts, and appraisals you have. For clothing, count the items you own by category -- pants, coats, shoes, for example –- making notes about those that are especially valuable. For major appliance and electronic equipment, record their serial numbers usually found on the back or bottom.

- Don't be put off! If you are just setting up a household, starting an inventory list can be relatively simple. If you’ve been living in the same house for many years, however, the task of creating a list can be daunting. Still, it’s better to have an incomplete inventory than nothing at all. Start with recent purchases and then try to remember what you can about older possessions.

- Big ticket items Valuable items like jewelry, art work and collectibles may have increased in value since you received them. Check with your agent to make sure that you have adequate insurance for these items. They may need to be insured separately.

- Take a picture Besides the list, you can take pictures of rooms and important individual items. On the back of the photos, note what is shown and where you bought it or the make. Don’t forget things that are in closets or drawers.

- Videotape it Walk through your house or apartment videotaping and describing the contents. Or do the same thing using a tape recorder.

- Use a personal computer Use your PC to make your inventory list. Personal finance software packages often include a homeowners room-by-room inventory program.

- Storing the list, photos and tapes Regardless of how you do it (written list, floppy disk, photos, videotape or audio tape), keep your inventory along with receipts in your safe deposit box or at a friend's or relative's home. That way you’ll be sure to have something to give your insurance representative if your home is damaged. When you make a significant purchase, add the information to your inventory while the details are fresh in your mind.

Sunday, October 28, 2007

Can I get insurance if I rent my home?

Renters insurance provides financial protection against the loss or destruction of your possessions when you rent a house or apartment. While your landlord may be sympathetic to a burglary you have experienced or a fire caused by your iron, destruction or loss of your possessions is not usually covered by your landlord’s insurance. Because in most cases, renters insurance covers only the value of your belongings, not the physical building, the premium is relatively inexpensive.

By purchasing renters insurance, your possessions are covered against losses from fire or smoke, lightning, vandalism, theft, explosion, windstorm and water damage (not including floods). Like homeowners insurance, renters insurance also covers your responsibility to other people injured at your home or elsewhere by you, a family member or your pet and pays legal defense costs if you are taken to court.

Renters insurance covers your additional living expenses if you are unable to live in your apartment because of a fire or other covered peril. Most policies will reimburse you the difference between your additional living expenses and your normal living expenses but still may set limits as to the amount they will pay.

There are two types of renters insurance policies you may purchase:

- Actual Cash Value – pays to replace your possessions minus a deduction for depreciation up to the limit of your policy

- Replacement Cost – pays the actual cost of replacing your possessions (no deduction for depreciation) up to the limit of your policy

With either policy, you may want to consider purchasing a floater. A standard renters policy offers only limited coverage for items such as jewelry, silver, furs, etc. If you own property that exceeds these limits, it is recommended that you supplement your policy with a floater. A floater is a separate policy that provides additional insurance for your valuables and covers them for perils not included in your policy such as accidental loss.

Saturday, October 27, 2007

Can I own a home without homeowners insurance?

Unlike driving a car, you can legally own a home without homeowners insurance. But, if you have bought your home and financed the purchase with a mortgage, your lender will most likely require you to get homeowners insurance coverage. That’s because lenders need to protect their investment in your home in case your house burns down or is badly damaged by a storm, tornado or other disaster.

If you live in an area that is likely to flood, the bank will also require you to purchase flood insurance. Some financial institutions may also require earthquake coverage if you live in a region vulnerable to earthquakes. If you buy a co-op or condominium, your board will probably require you to buy homeowners insurance.

After your mortgage is paid off, no one will force you to buy homeowners insurance. But it is not advisable to cancel your policy and risk losing what you’ve invested in your home.

Friday, October 26, 2007

What type of disasters are covered?

Most homeowners policies cover all disasters listed below. Some policies provide coverage only for the first 10 listed. Check your insurance policies for the "perils" covered.

- Floods You can purchase flood coverage directly from your homeowners insurance agent. However, the policy is provided by the Federal Flood Insurance Program ( 888-379-9531, http://www.floodsmart.gov/ ). You can get replacement cost coverage for the structure of your home, but only actual cash value coverage is available for your possessions. There may also be limits on coverage for furniture and other possessions stored in your basement. Flood insurance is available for renters as well as homeowners. You will need flood insurance if you live in a designated flood zone. But also consider buying it if your house could be flooded by melting snow, an overflowing creek or water running down a steep hill. Don’t wait until the evening news announces a flood season warning to buy a policy. There is a 30-day waiting period before coverage takes effect.

- Earthquakes Earthquake coverage can be a separate policy or an endorsement to your homeowners or renters policy. It available from most insurance companies. In California, it is also available from the California Earthquake Authority ( http://www.earthquakeauthority.com/ ). In earthquake prone states like California, the policy comes with a high deductible.

- Maintenance damage It is your responsibility to take reasonable precautions to protect your home from damage. Your insurance policy will not cover damage due to lack of maintenance, mold, termite infestation and infestation from other pests.

Thursday, October 25, 2007

Does my homeowners insurance cover flooding?

Standard homeowners policies do NOT cover flooding. You can purchase flood coverage directly through your homeowners insurance agent. However, the policy is provided by the Federal Flood Insurance Program ( 888-379-9531, http://www.floodsmart.gov ).

Replacement cost coverage is available for the structure of your home, but only actual cash value coverage is available for your possessions. Replacement cost coverage pays to rebuild your home as it was before the damage. Actual cash value is replacement cost coverage minus depreciation so that the older your possessions are, the less you will get if they are damaged. There may also be limits on coverage for furniture and other belongings stored in your basement.

Flood insurance is available for renters as well as homeowners. You will need flood insurance if you live in a designated flood zone. But flooding can also occur in inland areas and away from major rivers. Consider buying a flood insurance policy if your house could be flooded by melting snow, an overflowing creek or pond or water running down a steep hill. Don’t wait for a flood season warning on the evening news to buy a policy—there is a 30-day waiting period before the coverage takes effect.

The federal flood insurance program provides only limited coverage. If you need more coverage than the federal program provides, additional coverage known as “excess” flood insurance is available from specialized insurance companies. Depending on the amount of coverage purchased, an excess flood insurance policy will cover damage above the limits of the federal program on the same basis as the federal program—replacement cost for the structure and actual cash value for the contents.

Excess flood insurance is available in all parts of the country—in high risk flood zones along the coast and close to major rivers as well as in areas of lower risk—wherever the federal program is available. It can be purchased from specialized companies such as Lexington Insurance Company, part of American International Insurance Company, and Lloyd’s through independent insurance agents, or from regular homeowners insurance companies that have arrangements with a specialized insurer to provide coverage to their policyholders.

Wednesday, October 24, 2007

What type of insurance do I need for a co-op or condo?

If you have purchased a condo or co-op, the bank will require insurance to protect its investment in your home. You may, however, need more insurance to cover your personal items, liability or fees that may be charged to you regarding shared areas of the building like the lobby.

You will need two separate policies to protect your investment:

- Your own insurance policy.This provides coverage for your personal possessions, structural improvements to your apartment and additional living expenses if you are the victim of fire, theft or other disaster listed in your policy. You also get liability protection.

- A "master policy" provided by the condo/co-op board.This covers the common areas you share with others in your building like the roof, basement, elevator, boiler and walkways for both liability and physical damage.

To adequately insure your apartment, it is important to know which structural parts of your home are covered by the condo/co-op association and which are not. You can do this by reading your association’s bylaws and/or proprietary lease. If you have questions, talk to your condo association, insurance professional or family attorney.

Sometimes the association is responsible for insuring the individual condo or co-op units, as they were originally built, including standard fixtures. The individual owner, in this case, is only responsible for alterations to the original structure of the apartment, like remodeling the kitchen or bathtub. Sometimes this includes not only improvements you make, but those made by previous owners.

In other situations, the condo/co-op association is responsible only for insuring the bare walls, floor and ceiling. The owner must insure kitchen cabinets, built-in appliances, plumbing, wiring, bathroom fixtures etc.

Also ask your insurance professional about the following additional coverages:

- Unit assessmentThis reimburses you for your share of an assessment charged to all unit owners as a result of a covered loss. For instance, if there is a fire in the lobby, all the unit owners are charged the cost of repairing the loss.

- Water back-upThis insures your property for damage by the back-up of sewers or drains. Water back-up may not always be included in a policy. Check to see that it is included.

- Umbrella liabilityThis is an inexpensive way to get more liability protection and broader coverage than is included in a standard condo/co-op policy.

- Flood or earthquakeIf you live in an area prone to these disasters, you will need to purchase seperate flood and earthquake policies. Flood insurance is available through FEMA's National Flood Insurance Program ( http://www.floodsmart.gov/floodsmart/pages/index.jsp ). Both flood and earthquake insurance can be purchased through your insurance agent.

- Floater or endorsementIf you own expensive jewelry, furs or collectibles, you might consider getting additional coverage since there is generally a $1,000 to $2,000 limit for theft of jewelry on a standard policy.

When purchasing insurance, it is important to find an agent or company that specializes in condominiums or co-ops. Also don’t forget to ask about all available discounts. You can reduce your rates by raising your deductibles and by installing a smoke and fire alarm system that rings at an outside service. If you insure your unit with the same company that underwrites your building’s insurance policy, you might also get an additional reduction in premiums.

Tuesday, October 23, 2007

Are there different types of policies?

Yes. A person who owns his or her home would have a different policy from someone who rents. Policies also differ on the amount of insurance coverage provided.

The different types of homeowners policies are fairly standard throughout the country. However, individual states and companies may offer policies that are slightly different or go by other names such as “standard” or “deluxe”. The one exception is the state of Texas, where policies vary somewhat from policies in other states. The Texas Insurance Department ( http://www.tdi.state.tx.us/ ) has detailed information on its various homeowners policies.

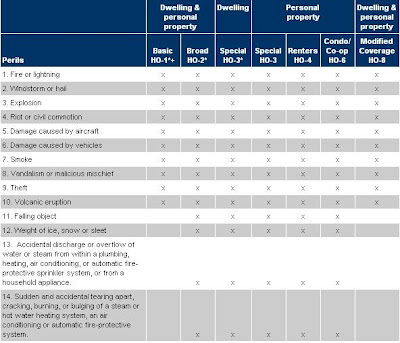

The chart below lists the disasters covered in each of the following types of policies:

If you own your home

If you own the home you live in, you have several policies to choose from. The most popular policy is the HO-3, which provides the broadest coverage. Owners of multi-family homes generally purchase an HO-3 with an endorsement to cover the risks associated with having renters live in their homes.

HO-1: Limited coverage policy This “bare bones” policy covers you against the first 10 disasters. It's no longer available in most states.

HO-2: Basic policyA basic policy provides protection against all 16 disasters. There is a version of HO-2 designed for mobile homes.

HO-3: The most popular policy This “special” policy protects your home from all perils except those specifically excluded. (Click on the link below for a sample HO-3 form; you will need Acrobat which you can download, free of charge, from the Adobe Web site: http://www.adobe.com/products/acrobat/).

HO-8: Older home Designed for older homes, this policy usually reimburses you for damage on an actual cash value basis which means replacement cost less depreciation. Full replacement cost policies may not be available for some older homes.

If you rent your home

HO4-RenterCreated specifically for those who rent the home they live in, this policy protects your possessions and any parts of the apartment that you own, such as new kitchen cabinets you install, against all 16 disasters.

If you own a co-op or a condo

H0-6: condo/co-opA policy for those who own a condo or co-op, it provides coverage for your belongings and the structural parts of the building that you own. It protects you against all 16 disasters.

Your level of coverage

Regardless of whether you are an owner or renter, you have the following three options:

- Actual cash value. This type of policy pays to replace your home or possessions minus a deduction for depreciation.

- Replacement cost. The policy pays the cost of rebuilding/repairing your home or replacing your possessions without a deduction for depreciation.

- Guaranteed or extended replacement cost. This policy offers the highest level of protection. A guaranteed replacement cost policy pays whatever it costs to rebuild your home as it was before the fire or other disaster–even if it exceeds the policy limit. This gives you protection against sudden increases in construction costs due to a shortage of building materials after a widespread disaster or other unexpected situations. It generally won't cover the cost of upgrading the house to comply with current building codes. You can, however, get an endorsement (or an addition to) your policy called Ordinance or Law to help pay for these additional costs. A guaranteed replacement cost policy may not be available if you own an older home.

Some insurance companies offer an extended, rather than a guaranteed replacement cost policy. An extended policy pays a certain percentage over the limit to rebuild your home. Generally, it is 20 to 25 percent more than the limit of the policy. For example, if you took out a policy for $100,000, you could get up to an extra $20,000 or $25,000 of coverage.

Even though a guaranteed/extended replacement cost policy may be a bit more expensive, it offers the best financial protection against disasters for your home. These coverages, however, may not be available in all states or from all companies.

Monday, October 22, 2007

What is in a standard homeowners insurance policy?

A standard homeowners insurance policy includes four essential types of coverage. They include:

- Coverage for the structure of your home.

- Coverage for your personal belongings.

- Liability protection.

- Additional living expenses in the event you are temporarily unable to live in your home because of a fire or other insured disaster.

The structure of your house

This part of your policy pays to repair or rebuild your home if it is damaged or destroyed by fire, hurricane, hail, lightning or other disaster listed in your policy. It will not pay for damage caused by a flood, earthquake or routine wear and tear. When purchasing coverage for the structure of your home, it is important to buy enough to rebuild your home.Most standard policies also cover structures that are detached from your home such as a garage, tool shed or gazebo. Generally, these structures are covered for about 10% of the amount of insurance you have on the structure of your home. If you need more coverage, talk to your insurance agent about purchasing more insurance.

Your personal belongings

Your furniture, clothes, sports equipment and other personal items are covered if they are stolen or destroyed by fire, hurricane or other insured disaster. Most companies provide coverage for 50% to 70% of the amount of insurance you have on the structure of your home. So if you have $100,000 worth of insurance on the structure of your home, you would have between $50,000 to $70,000 worth of coverage for your belongings. The best way to determine if this is enough coverage is to conduct a home inventory.This part of your policy includes off-premises coverage. This means that your belongings are covered anywhere in the world, unless you have decided against off-premises coverage. Some companies limit the amount to 10% of the amount of insurance you have for your possessions. You have up to $500 of coverage for unauthorized use of your credit cards.Expensive items like jewelry, furs and silverware are covered, but there are usually dollar limits if they are stolen. Generally, you are covered for between $1,000 to $2,000 for all of your jewelry and furs. To insure these items to their full value, purchase a special personal property endorsement or floater and insure the item for it's appraised value. Coverage includes “accidental disappearance,” meaning coverage if you simply lose that item. And there is no deductible. Trees, plants and shrubs are also covered under standard homeowners insurance. Generally you are covered for 5% of the insurance on the house—up to about $500 per item. Perils covered are theft, fire, lightning, explosion, vandalism, riot and even falling aircraft. They are not covered for damage by wind or disease.

Liability protection

Liability covers you against lawsuits for bodily injury or property damage that you or family members cause to other people. It also pays for damage caused by your pets. So, if your son, daughter or dog accidentally ruins your neighbor’s expensive rug, you are covered. However, if they destroy your rug, you are not covered.The liability portion of your policy pays for both the cost of defending you in court and any court awards—up to the limit of your policy. You are also covered not just in your home, but anywhere in the world.Liability limits generally start at about $100,000. However, experts recommend that you purchase at least $300,000 worth of protection. Some people feel more comfortable with even more coverage. You can purchase an umbrella or excess liability policy which provides broader coverage, including claims against you for libel and slander, as well as higher liability limits. Generally, umbrella policies cost between $200 to $350 for $1 million of additional liability protection.Your policy also provides no-fault medical coverage. In the event a friend or neighbor is injured in your home, he or she can simply submit medical bills to your insurance company. This way, expenses are paid without a liability claim being filed against you. You can generally get $1,000 to $5,000 worth of this coverage. It does not, however, pay the medical bills for your family or your pet.

Additional living expenses

This pays the additional costs of living away from home if you can't live there due to damage from a fire, storm or other insured disaster. It covers hotel bills, restaurant meals and other living expenses incurred while your home is being rebuilt. Coverage for additional living expenses differs from company to company. Many policies provide coverage for about 20% of the insurance on your house. You can increase this coverage, however, for an additional premium. Some companies sell a policy that provides an unlimited amount of loss-of-use coverage, but for a limited amount of time.If you rent out part of your house, this coverage also reimburses you for the rent that you would have collected from your tenant if your home had not been destroyed.

Sunday, October 21, 2007

HOMEOWNERS BASICS

What is homeowners insurance?

What is homeowners insurance?- What is in a standard homeowners insurance policy?

- Are there different types of policies?

- What type of insurance do I need for a co-op or condo?

- Does my homeowners insurance cover flooding?

- What type of disasters are covered?

- Can I own a home without homeowners insurance?

- Can I get insurance if I rent my home?

- How do I take a home inventory and why?

- What's the difference between cancellation and nonrenewal?

What is homeowners insurance?

Homeowners insurance provides financial protection against disasters. A standard policy insures the home itself and the things you keep in it.Homeowners insurance is a package policy. This means that it covers both damage to your property and your liability or legal responsibility for any injuries and property damage you or members of your family cause to other people. This includes damage caused by household pets.

Damage caused by most disasters is covered but there are exceptions. The most significant are damage caused by floods, earthquakes and poor maintenance. You must buy two separate policies for flood and earthquake coverage. Maintenance-related problems are the homeowners' responsibility.Saturday, October 20, 2007

How to get the best home insurance quote

There are four main options when searching for the best home insurance deal:

- Home insurance brokers – Brokers have been with us for decades but are limited as they can only contact the insurers they have deals with.

- Direct insurers – Also known as direct writers - they ‘cut out the middle man’ in the form of the broker. Commissions sent to the broker can now be savings for the consumer.However, direct insurers will spend massive amounts of money on marketing.

- Branded providers – Large UK brands, such as supermarkets or retail chains, use their brand recognition to branch into other areas. However, your choice is still limited to their products from a direct insurer or broker.

- The ‘Full Search’ provider – The full search provider allows you to enter your details and returns quotes from a wide list of insurers, direct insurers, brokers and UK brands. By examining the market in just minutes you can save time and money.

So if it’s the cheapest and best home insurance deal you’re looking for, then why not enter your details now on the price comparison tool at moneysupermarket.com? Within minutes you will see a list of quotes suited to your needs from more than 60 insurance providers.

Friday, October 19, 2007

Cutting the risk

One of the best ways to reduce your home insurance premium is to cut the risk of the insurer having to pay out. This can be done in a number of ways:

- Security measures to reduce theft risk – Fit a burglar alarm, change locks, install time-switch lights, join a neighbourhood watch scheme, install security lighting, etc. NACASS standard alarms can get you up to a 7.5% discount.

- Reduce fire risk – Fit and maintain smoke alarms.

- Increase the standard policy excess – If you are willing to cover more of the cost of any claim then you will reduce your home insurance premium.

- No claims – The fewer the claims, the lower your premium. Also see which home insurance companies offer a no claims discount. This can save you up to 20% on your premiums.

For more money-saving ideas read the moneysupermarket.com top tips section.

Do your research

The best way to cut the cost of your home insurance is to get the best deal available for you. To do this, you will need to shop around. Using the price comparison tool at moneysupermarket.com will save you time, effort and money. Just fill out the form and in two minutes it will compare prices from more than 60 different home insurance companies to help you find the cheapest home insurance quote available.

This does not mean however, that you should simply accept the cheapest quote you find. The reputation of an insurance provider is also very important so you might wish to pay a bit more if an insurer is highly recommended by a friend or family member.

Another way to cut your home insurance premium might be to move house. A nationwide survey by the AA showed premiums could differ by 300% depending on where you live. Moving away from these postcode hotspots might be the best way to cut your premium.

Now you know how to get the right home insurance deal for you, the next step is to consider how to make a claim.

Making a claim

When it comes to making a claim you should notify the insurance company as quickly as possible. There is often a clause in your contract that makes it mandatory for you to contact the company as quickly as possible, though in the case of a theft, it is necessary to contact the police first.

Decide which policy to claim under and then contact your insurance provider. They should then send a claim form, which needs to be filled out with estimates for your repairs/replacements. If you have ‘new for old’ cover you can claim for the full cost of replacement items. If you have an indemnity policy you must deduct an amount to represent wear and tear.

For a major claim a company could send around their own loss adjustor to assess whether you are in compliance with the terms of the policy. This can potentially lead to the company refusing to pay out, which is why it is vital to read the small print and always make sure you give the company accurate information.

Exclusions

It is crucial to be aware of elements that might threaten your claim. These can include:

- Falsified information.

- Lack of maintenance – any repair work due to your negligibility is unlikely to be covered.

- Failure to install security systems.

- Failure to carry out repair work on previous claims.

Also bear in mind that it can sometimes make more sense to pay for relatively inexpensive repairs yourself than make claims on your insurance. This will allow you to build up your no claims bonus.

Thursday, October 18, 2007

Student possession insurance

Students, when compared to regular homeowner and renters, are usually seen differently by home insurance companies.

Student possession insurance is tailored to meet the students’ needs as they often have a lot of unsecured possessions and are considered more vulnerable to theft. In addition they are regularly away from home for a long periods making their possessions even more vulnerable. Student policies will usually cover high-risk items such as CD players, games consoles, etc as well as the standard fire, flood, vandalism, theft and accidental damage.

What is also worth considering is that many students’ possessions will already be covered on their parents’ policy. Parents can make an immediate saving by avoiding duplicate cover.

Self build insurance

When building a new home there are a number of factors worthy of consideration – including serious injury or anything that incapacitates the self-builder. Here is a guide to some of the things to consider:

- Public liability insurance – Insure against potential claims from members of the public.

- Existing structures – This insures the lenders interest is noted.

- Insure the actual building work and materials – Contractors All Risks (CAR) insures the structure and provides cover for ‘in transit’ materials.

- Employers liability insurance – Anyone, including friends and volunteers who are injured working on the home could make a claim. This policy dovetails your liability as an employer.

- Further liability insurance – Protection against injury to any third party, for example personal accident cover.

- Contractor/supplier disputes – Legal expenses cover can help speed up disputes over sub-standard work or materials.

Listed buildings insurance

There are more than 500,000 listed buildings in the UK but many home insurance brokers do not cover their complexities and a lot of homeowners under insure their property. In the event of a catastrophe, English Heritage insists on a full reinstatement if more than 40% of the historic fabric has survived. Consequently, there are a number of factors to consider:

- Reinstatement Cover – Due to the English Heritage mandate there is a need to consider how much it would cost to rebuild the entire building using like for like methods and materials.

- Valuation – A proper valuation is essential from historic building experts.

- Specialist Insurers – Most home insurers will just look at the rebuilding costs from the exterior, which is not acceptable for a listed building. A specialist insurer is required.

- Documentation – Become involved in the process so a resolution of a claim with the home insurance company is easier to reach.

- High Net Worth Cover – High net worth cover will usually cover buildings with a value of more than £250,000 and contents in excess of £75,000.

Holiday home/expatriate insurance

If a person is away from their home for a long period of time staying at a holiday home, their home insurance policy can often be deemed void. Some home insurance companies will now offer cover for holiday homes in selected countries, based on how long you spend there, etc. Expatriate home insurance is also available with selected companies for people who relocate to Spain and other countries.

Working from home

If you work from home it is vital to look at the range of cover options available from your home insurance policy. Some insurers automatically cover up to £5,000 of home office equipment. This is likely to be adequate unless you use specialist equipment or employ other people, in which case you will need to speak to your insurer about the possibility of gaining specialist cover. You could need extra cover for more valuable items, and items that are particularly susceptible to theft, such as laptops, could need a separate policy. If your computer is stolen and you make a claim your home insurance premium could go up as a result, meaning it is generally worthwhile to insure these items separately.

Posted by

PungPond

At

9:11 AM

13

Comment

![]()

Wednesday, October 17, 2007

Tenant’s insurance

With more and more people priced out of the housing market it has become crucial for home insurance companies to specifically cover the needs of tenants who have different needs from the average homeowner as they generally do not have to insure the building and only have to insure a limited number of contents.

By taking out a regular homeowners insurance policy, a tenant will generally face a higher premium than they need. A specific policy should match your needs more accurately and also allow for additional options including home emergency cover.

Landlord’s insurance

Landlord’s home insurance is varied by nature. All landlords will need to have buildings insurance but contents insurance is available to a varying degree depending on how the property is furnished.

Here are some of the additional options available to landlords:

- Emergency Assistance – This covers the cost of a contractor’s call-out up to a maximum limit (for example £500) for work done. It will not cover incidents arising from a lack of routine maintenance.

- Legal Cover – Cover for legal expenses to assist with issues such as tenants not paying rent, failure to leave a property or unauthorised inhabitants, etc.

- Rent Guarantee – This pays the rent you are expecting if the tenant refuses to pay while vacant possession is obtained and for three months until a new tenant is found.

Flood risk cover

In recent times flooding has become one of the leading news stories in the UK. Due to climate changes, floods are becoming more frequent and more devastating in nature. Consequently, home insurance flood-risk cover is more and more important, but also increasingly expensive for those in flood-risk areas.

The Environment Agency carries a flood map indicating areas that are under threat from flooding. If you live in one of these areas it is vital to take measures to protect your property in order to cut home insurance premiums and the Environment Agency has issued a ‘Preparing for Floods’ guidance document that contains advice on simple, low-cost measures to limit damage.

Among the suggestions to help cut premiums are:

- Making sure important equipment and valuables are stored in dry areas.

- Consider temporary flood barriers.

- Consider fitting valves to prevent sewage flowing backwards.

- Use materials that are more flood-resistant on floors, walls, etc.

- Raise gas appliances and sockets above flood level.

- Install flood defences within the landscaping of housing developments.

Clearly some of these suggestions are for builders rather than homeowners, but it is worth seeing how many are in place to help you secure cheaper home insurance.

Saturday, October 13, 2007

Buildings & contents insurance combined

There could be discounts available for taking both policies out with the same insurer and it can certainly save some hassle. However, just because an insurer is good for buildings insurance, it does not mean that they will be the best for contents insurance and vice-versa. Be sure to examine all of the options available.

Contents insurance – variable options

There are a number of add-on options available in addition to a standard contents insurance policy. These include:

New for old replacement cover – This replaces items with equivalent new versions at today’s prices.

All risks cover – Includes items taken outside your home. These items are usually specified individually, such as jewellery, mobile phones, etc.

Legal cover – This pays for court costs. There are a number of different policies available including:

- Compensation for injuries – If you are in an accident that’s not your fault you could claim compensation.

- Consumer disputes – Disputes from buying, holding or selling goods.

- Disputes with neighbours – Such as new fences, trees blocking light, etc.

Freezer contents cover – Will pay for a fixed amount should the food in your fridge or freezer become inedible.

Sports equipment cover – Such as golf clubs, squash racquets. They will not usually be covered while in use.

Garden equipment cover – Protects against theft from a garden shed.

Additionally, an option to consider is accidental damage cover, which is standard in a lot of policies. This covers against DIY accidents, paint spillages, etc and is available in both building and contents insurance.

Make sure you examine exactly what your insurance policy covers against. All levels of cover should include compensation against theft and fire. However, it could be important to make sure you are covered against storms and flooding, frozen pipes, subsidence and more. Also, if you have extended or plan to extend your property make sure your policy reflects the changes you make.

Contents insurance – types of cover

It’s vital to avoid under insuring the contents of your home. Most policies will ask you to define a ‘sum insured’ – this will be the maximum your insurer will pay out. Under insuring can have drastic consequences because if, for example, the value of the contents of your home is £20,000 and you insure for £10,000 then you will effectively halve the value of your contents. So if you needed a new carpet valued at £2,000, your insurer would only pay £1,000. Be sure to calculate the correct amounts for all of the contents.

The best way to do this is to create a checklist of absolutely everything you have in and around your home. Be sure to include things you have made as well as anything that has been given to you because these things will need to be replaced too. Try to include an approximate date when the items were bought and include any receipts you might have. It’s a fairly lengthy process but well worth the effort to ensure that the contents are insured properly.

Also remember about the limit insurers could place on individual items, as it could be lower than some of your possessions. If this is the case you have three options:

Negotiate for the full value to be included.

Insure the item separately.

Break the item down into components of lower value where possible, for example: a camera can have a lens, the main body and peripheral equipment insured separately.

Follow the advice in our home insurance calculator section to evaluate the cost of the contents of your home. (opens home insurance calculator content in new window)

There are a number of variables that can be considered with contents insurance.

Buildings insurance – types of cover

The most important factor when insuring your property is to cover the full rebuilding cost and not the market value. The land under your house is not under threat from theft, storms and fire and as the land is normally about a third of the total property value it is important to make sure you cover rebuilding costs rather than market value. It can often prove less costly to rebuild your house from scratch than to buy another, as the land it sits on will usually remain unscathed.

Remember, the same type of house in a slightly different area can have a lower market value than another but yet cost just the same to rebuild in the event of a fire, etc. Therefore, cover your house against the rebuilding cost, and not against its market value.

To evaluate rebuilding costs follow the advice in our home insurance calculator section. (opens home insurance calculator content in new window)

Friday, October 12, 2007

Contents Insurance

Contents insurance gives protection to anything that is not a fixed part of your home, for example your appliances, electronic goods, furniture and clothing. Most home contents insurance policies will even cover the contents of your fridge and freezer. Policies are advisable for homeowners and tenants while landlord contents insurance can be limited if the property is let unfurnished or part furnished.

The cheapest contents insurance available is indemnity insurance, which will replace, for example, a five-year-old carpet with one of the same age. A more expensive option is the ‘new for old’ policy that replaces the old carpet with a brand new one.

Your home contents insurance could also include cover for some items you take away from the home such as bicycles or prams and even the contents of your handbag. Clothing items, watches and mobile phones can also be covered along with sports equipment – though this is not usually covered when it is in use. The key is to check your policy and never assume that items are covered.

Garden plants are increasingly covered in contents insurance policies – treat your garden as another room and add up the costs of replacements. High value items, such as those more than £1,000 in value, will generally have to be considered separately from your contents policy.

Similarly to building insurance, contents insurance offers protection against various perils including:

- Fires

- Storms/flooding

- Explosions

- Theft and vandalism

Policies can also include cover in the event of an injury in your home. Furthermore, some contents insurance policies would also cover you for legal liability if someone were injured in your home due to your negligence or lack of upkeep of the property.

Thursday, October 11, 2007

Buildings Insurance

Buildings insurance is of vital importance – for example, if your house burnt down do you have the money to cover your losses? Mortgage providers insist that you have building insurance so that in the event of a disaster it can be repaired or rebuilt, as lenders don’t want to be left without security for their loan.

A policy should cover funds to rebuild your home in the event of it being totally destroyed or damaged to the point that complete rebuilding is necessary. Some policies only cover market value, so be sure to check. The policy could also cover against damage caused by events beyond your control including:

- Storm and flood damage

- Burst pipes and other incidents of water leakage

- Fire, smoke and explosions

- Subsidence

- Vandalism or third party damage

The policy could also provide you with alternative accommodation if your home is uninhabitable. Be sure to not simply opt for the cheapest building insurance quote available and think about your needs. Use the price comparison tool at moneysupermarket.com to find a building insurance policy that offers the best cover at the cheapest price.

As well as the structure, buildings insurance also covers permanent fixtures and fittings including baths, toilets and fitted kitchens, bedroom cupboards and interior decorations. The test is whether or not the fixture can be removed and taken to a new home, for example fitted cabinets. Policies will also usually cover outbuildings such as garages, greenhouses and garden sheds but might not cover boundary walls, fences, gates, paths, drives and swimming pools.

For landlords, building insurance is crucial, as it is for all homeowners. For tenants, building insurance is usually covered by the landlord and only contents insurance needs to be considered.

In part three we take a look at contents insurance.

Why is home insurance necessary?

It’s easy to think that bad things happen to other people and not ourselves, but the facts suggest that isn’t a risk we can afford to take. In the UK, one in three of us will get burgled at some point in our lives yet about a quarter of households are not protected by any form of home insurance. With other unfortunate occurrences such as flood/storm damage, fire and more, threatening our homes and their contents, by not having insurance we are leaving ourselves open to serious financial loss.

Home insurance can now offer something for everyone with insurance for homeowners, tenants and landlords. Increasingly, mortgage lenders will insist that you have buildings insurance to obtain a mortgage.

Insurers will need a lot of information including the construction date and materials for the building, and different insurers might not insure unusual properties such as prefabricated buildings and thatched cottages. Insurers also need to know about the local lie of the land to assess the flood-risk.

In part two we take a look at the different types of home insurance cover available.

Wednesday, October 10, 2007

Home Insurance Guide

Home sweet home; there are few things more valuable in life than our own personal space or the home we make for our families. Our place to live is often the most valuable commodity in our lives and the contents within are frequently not just expensive, but of great personal value.

At moneysupermarket.com we recognise the need to protect your home, which is why our price comparison tool allows you to compare home insurance quotes (also known as ‘house insurance’ or ‘household insurance’) from more than 60 different home insurance companies to get you the best home insurance price available. However, before you use the tool it is vital to know exactly what you are looking for and what you need from your policy. That is why we have compiled an exclusive guide to home insurance to point you in the right direction.